It can get old hearing about the importance of fiscal responsibility and maintaining healthy credit scores, even if you love learning about personal finance. However, getting this one wrong early in life can make the rest of it a lot tougher.

Here we cover what a Fair Isaac Corporation (FICO) credit score is, what the FICO Score credit categories are, how they are calculated, and how to use this information to increase your own FICO Score to obtain more funds with better interest rates.

Whether you like it or not, your credit history is important. It’s nearly impossible to get approved for a good credit card, a fair-rate mortgage loan, or an affordable auto loan without a solid credit score to back you up.

A credit score is a 3-digit number determined by calculations that rank your creditworthiness and the risk associated with offering you credit. The most commonly used credit scoring system is FICO. It has a basic credit score range of 300-850.

Although there are various credit ranking systems in use today, including VantageScore, FICO is still used by most of the top lending institutions. The exact equation and criteria used to calculate a person’s credit score are kept secret, but FICO does offer some details about the structure of its rating system.

How FICO Credit Scores are Determined

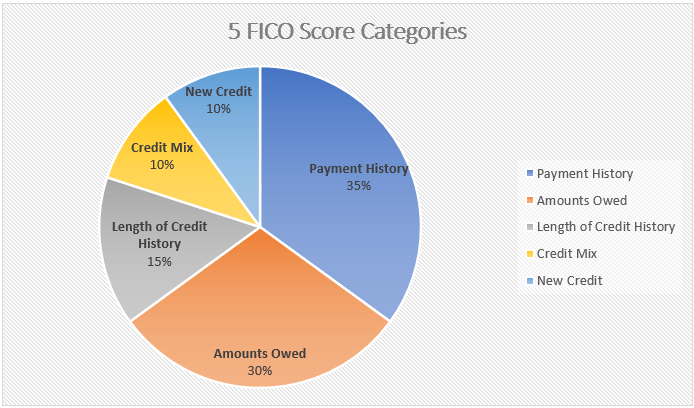

FICO breaks down each person’s credit score into five categories: payment history (35%), the amounts a person owes (30%), the average length of credit history (15%), the diversity of open credit accounts (10%), and the number of new credit accounts (10%).

Let’s look at each category, starting with this pie chart.

1. Payment History (35 percent)

The payment history category is the most important and influential to your credit score. Your monthly credit card, loan, and line of credit payments are reported to each of the three main consumer credit bureaus, Equifax, Experian, and TransUnion, by creditors. These details are then used in your credit score calculation.

If you miss a payment, it will be recorded on your credit report and impact your score negatively. Missing a payment is one of the quickest ways to drop your FICO Score substantially.

Conversley, making consistent on-time payments shows that you are a responsible borrower living within your means. Over time, it will have a positive impact on your credit score.

2. Amounts Owed (30 percent)

The amount owed on credit cards, lines of credit, and outstanding loans is the second most important factor in calculating your FICO credit score. Especially, the percentage of available credit limits you are using. Say you have a credit limit of $5,000 on a credit card. If you carry a $1,500 balance, your credit utilization ratio would be thirty percent. This is on the higher end of what FICO considers a healthy credit utilization rate, but not bad.

Maintaining a high amount of debt on your credit cards, or worse, maxing them out, shows risky and unstable financial behavior, as per the FICO rating system. That negatively impacts your FICO credit score. Keep your credit utilization rate below thirty percent for a decent credit score, below twenty percent for a good score, and below ten percent for an excellent one.

FICO also looks at how much total debt is owed on all accounts, the amount owed on different types of accounts, how much debt is currently owed on installment loans versus the original loan amount, and how many accounts have balances.

As you can see, several factors are given weight under the amounts owed credit category, but none as crucial as your credit utilization rate. It’s best to keep your revolving balances low when seeking new credit.

3. Length of Credit History (15 percent)

Your credit history length is important too, but it doesn’t hold as much weight as the amounts you owe and your on-time payment history.

FICO Score considers the age of your oldest account, the age of your newest account, how long a specific credit account has been open, and the average age of all your accounts.

Lenders prefer borrowers with a long, documented history of taking on accounts and using them wisely.

Many people recommend keeping some of your oldest credit card accounts open, even if you don’t use them anymore, to help with your credit age. I don’t think it’s a bad idea unless your accounts become too difficult to manage.

4. Credit Mix (10 percent)

The type of credit accounts you have open, known as your credit mix, contributes to ten percent of your overall credit score. FICO looks positively on consumers with a variety of credit accounts open. It might seem weird to look favorably on those that do, but I’m sure there is plenty of data to back it up.

For example, having an open mortgage loan and a credit card will likely have a greater positive impact on your FICO score than just having two credit cards.

That’s because the FICO Score equations look at the diversity of your open credit accounts: credit cards, installment loans, and other lines of credit. That could include retail accounts, auto loans, mortgage loans, credit cards, a home equity line of credit, a secured credit card, and others.

Try diversifying your credit report with numerous types of credit if you want to boost your FICO score.

5. New Credit (10 percent)

When analyzing new credit, FICO Scores examine how many new accounts you have, how many inquiries you have, and how long it has been since you opened a new account.

FICO recommends not opening new credit accounts unless you need them. New accounts, plus the frequency with which you apply for them, could negatively affect your FICO credit score.

Hard inquiries, such as those made when actively applying for new credit, remain on your credit report for two years, but FICO Scores only consider inquiries from the last 12 months. Soft inquiries from checking your credit score on sites like CreditKarma don’t affect your FICO Score.

Either way, inquiries usually have a small impact on your credit score, and many inquiry types are ignored completely. FICO Scores also allow for rate shopping, so it is typically better to make a few inquiries within 30 days rather than the same inquiries spread out over several months.

The more accounts you have open, the less effect inquiries have on your FICO credit score.

What’s Considered a Good FICO Credit Score?

What is considered a good FICO Score can depend on which FICO Score model and formula is being used. Here’s a good rule of thumb taken directly from the myFICO website for a general FICO Score:

- <580 (Poor) – A bad credit score that indicates a risky borrower well below the average score of U.S. consumers.

- 580-669 (Fair) – A below-average credit score, but able to get approved for many credit cards and loans.

- 670-739 (Good) – An average credit score range that is considered good by most creditors.

- 740-799 (Very Good) – An above-average credit score demonstrating a dependable borrower.

- 800+ (Exceptional) – An excellent credit score that demonstrates a responsible borrower to lenders.

With the right education and knowledge, you can use the algorithms to implement new behaviors and strategies to grow your credit quickly, improve your FICO Score, and reach the next level of financial independence.